Profitability accelerates as contribution margin significantly exceeds guidance, with On-demand Services turning positive at the end of the quarter

- On-demand Services segment turned contribution margin positive in September

- Group contribution margin improved by 43% YoY and 41% QoQ, significantly beating guidance

- GTV up 33% year on year to Rp161 trillion, beating guidance

- Gross revenue up 30% year on year to Rp5.9 trillion, above middle point of guidance range

- Adjusted EBITDA loss narrowed by 11% YoY and 10% QoQ to Rp3.7 trillion

Jakarta, Indonesia, November 21, 2022 – PT GoTo Gojek Tokopedia Tbk (IDX: GOTO, “GoTo Group” or the “Company”), the largest digital ecosystem in Indonesia, today announced its financial results for the third quarter of 2022.

Andre Soelistyo, GoTo Group CEO, said: “We had a strong third quarter, rapidly accelerating our path to profitability as revenues grew and adjusted EBITDA losses narrowed. Group contribution margin significantly exceeded the guidance we shared last quarter and we achieved positive contribution margin for our On-Demand Services in September - well ahead of schedule. These gains were driven by our product-led focus on high quality users, alongside our disciplined approach to cost management. The ongoing expansion of GoPay Coins is a good example of this, as it allows us to rationalize promotional spending while spurring sustainable growth by rewarding users who utilize our services the most.

“The improved margins have not come at the expense of top line growth, demonstrating the resilience of our business and the relative strength of the Indonesian economy. The financial and operational results we achieved in the third quarter provide reassurance that we can accelerate even faster towards profitability, and we will continue to play to our strengths as the largest digital ecosystem in Indonesia.”

Jacky Lo, GoTo Group CFO, said: “Robust results in the third quarter of 2022 illustrate GoTo’s growth momentum and the strength of our model. We have taken steps to embed structural efficiencies into our operations, enhancing our ability to deliver on our growth and profitability targets. As a result, we have seen ongoing sequential improvements. GTV grew 33% year on year to Rp161 trillion and gross revenues were up 30% year on year to Rp5.9 trillion, while Group adjusted EBITDA improved by 44 basis points quarter on quarter.

“Global macro uncertainties driven by rising inflation, interest rates and fuel and energy prices, mean it is prudent to continue our focus on cost optimization across the business. Throughout the third quarter, we reduced incentives, eliminated promotional spend on cohorts of unprofitable users, further reduced product marketing spend and continued to develop a program of structural cost savings as we equip our business for the road that lies ahead.”

3Q221 Group Financial and Operational Highlights

- Contribution margin as a percentage of GTV improved by 61 basis points quarter on quarter to -0.7%.

- GTV2 grew 33% year on year to Rp161 trillion.

- Gross revenue3 increased by 30% year on year to Rp5.9 trillion.

- LTM annual transacting users (ATU)4 grew 20%, with average spend per user up 18%, and user transaction frequency increasing by 13%, all year on year.

- Total quarterly orders grew by 28% year on year to 693 million.

- Adjusted EBITDA5 loss narrowed by 10% quarter on quarter to Rp3.7 trillion from Rp4.1 trillion in 2Q22, marking the third consecutive quarter of improved adjusted EBITDA loss. This represents a YoY narrowing of 11% against a Rp4.2 trillion Adjusted EBITDA loss in 3Q21.

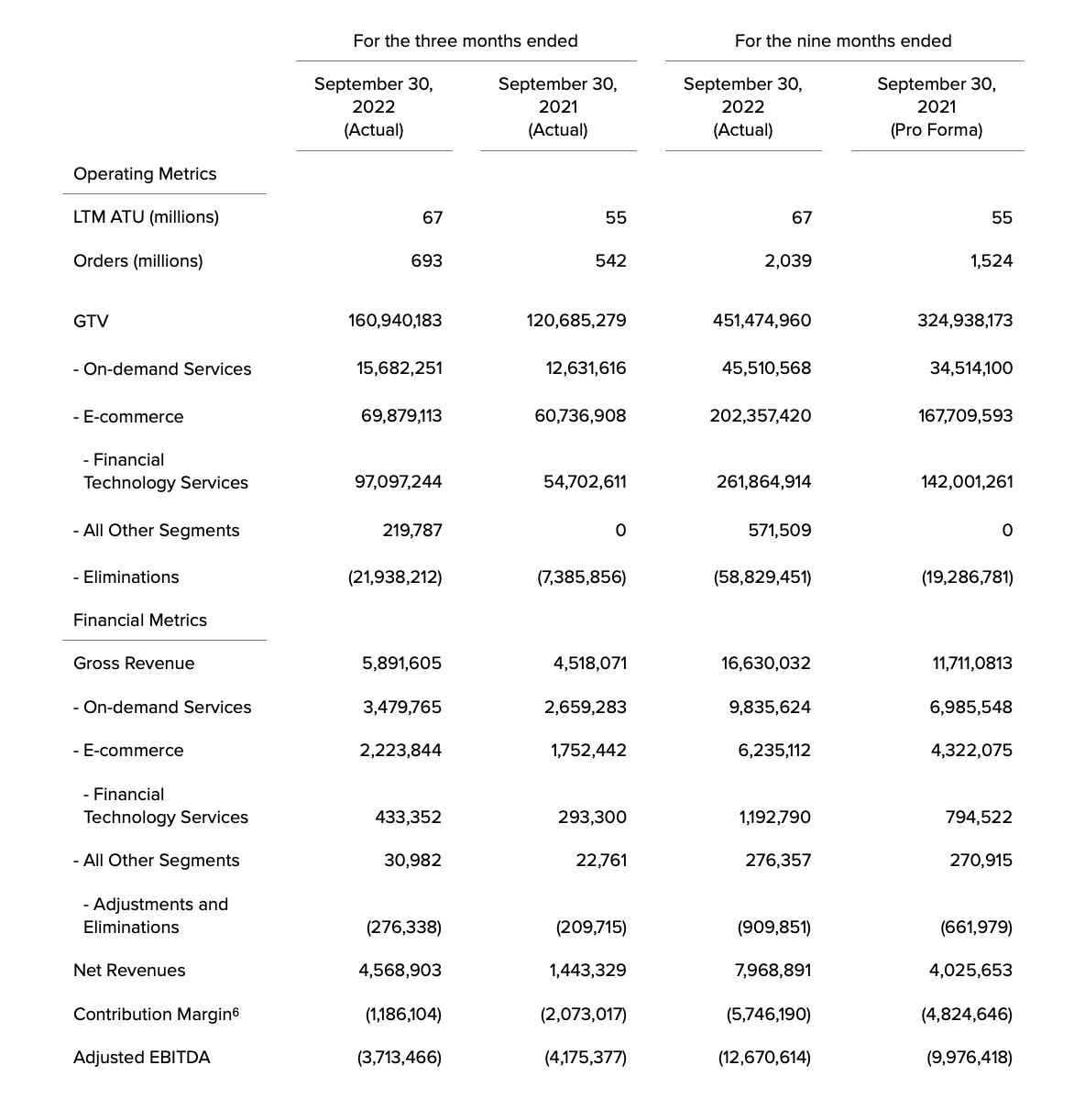

Summary of Key Financial and Operational Metrics

(Rp millions, unless otherwise stated)

3Q22 Business Overview

In the third quarter of 2022, we continued to drive monetization, incentive optimization and cost reductions, making strong progress toward profitability. Despite challenging macroeconomic conditions, third quarter 2022 GTV increased by 33% year on year and 7% quarter on quarter or 69 basis points, to Rp161 trillion, exceeding our guidance. In addition, gross revenue grew by 30% year on year and 7% quarter on quarter to reach Rp5.9 trillion, above the midpoint of our guidance range.

Behind our strong performance was a focus on high-quality users, including key product innovations like GoPay Coins, our unified rewards currency, that enables customers to earn, redeem and spend points for any transaction within the GoTo ecosystem. GoPay Coins was rolled out across the whole ecosystem at the end of June and has yielded promising results. Approximately 21% of our annual transacting user base have been issued with GoPay Coins. To date, the increased utilization of GoPay Coins has demonstrated 2.3x higher conversion for cross-platform user acquisition compared to other incentives, and lowered customer acquisition costs by 20% compared with standalone platform incentives.

We have also made further progress on product-led initiatives that aim to deepen user engagement across the GoTo ecosystem. GoTo Plus, our pilot subscription program announced last quarter, has achieved over 50k subscribers within a short period. Based on preliminary data, Plus subscribers transact and spend more than 5x compared to non-subscribers to date.

Growth in monetization, coupled with efficiency in incentives and promotional spending, resulted in contribution margin for On Demand Services turning positive in September and Group contribution margin improving faster than anticipated, beating guidance by 46 basis points quarter on quarter to reach -0.7% of our total GTV. This is the third consecutive quarter with sequential improvement in contribution margin.

Group adjusted EBITDA as a percentage of GTV improved by 44 basis points in the third quarter of 2022 to -2.3% from -2.8% in the second quarter of 2022.

Contributing to this were further cost savings through previously introduced workstreams and initiatives, which together with ongoing business-as-usual procurement initiatives, amounted to Rp 269 billion in savings year to date, including Rp 144 billion in operating expenses.

3Q22 Segment Financial and Operational Highlights

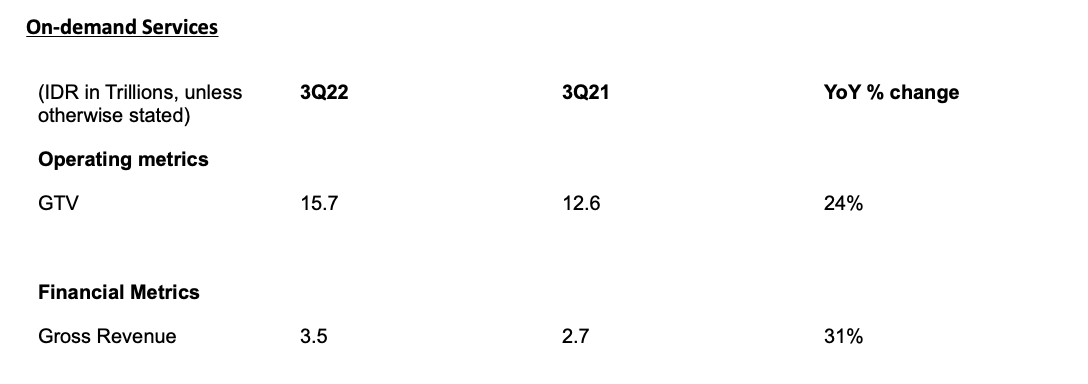

On-demand Services

On-demand services have been a key driver for overall growth in the third quarter on the back of continued improvement in mobility services, driven by the return to office and back-to-school demand. Third quarter gross revenue grew 31% year on year, with our gross revenue growth rate again exceeding that of GTV in the third quarter. This is mainly attributable to a higher take rate as we intensified our efforts on merchant-funded incentives and refined voucher targeting.

On-demand services GTV grew to Rp15.7 trillion in the third quarter of 2022, representing an increase of 24% year on year, of which mobility GTV recorded an increase of 111% year on year, having recovered to 94% of pre-COVID-19 levels. We see the upward trend continuing into the fourth quarter despite macro headwinds, and have released a variety of foundational products that deliver more value and convenience to customers. These include the GoRide Hemat service in mobility to provide a more economical option for riders in select cities in Indonesia. GoFood Hemat provides free or lower shipping for food orders within a 2km radius if users are willing to wait longer, while maintaining food quality.

Our GoTransit offering, in partnership with KCI, Indonesia's largest public transportation operator, allows customers to purchase KCI tickets through the Gojek app and has seen strong adoption since launching in June this year. GoTransit has quickly grown to become the market leader in online ticket sales, commanding 74% of KCI’s digital ticketing as of end-September. In addition, GoCorp B2B offerings continued to scale, with GTV increasing 2.3 times quarter on quarter, driven by a growing number of people returning to the office. Monetization efforts continued to make meaningful progress with the scaling of premium services and increased platform fees in mobility and increased take rates from renegotiated merchant commissions and platform fees in the food business.

For our food business, average basket sizes remained stable, a significant feat given more people are now dining out, indicating the platform's resilience as well as changing long-term consumer habits.

As a result of efforts to reduce incentives and product marketing spend on our food business, On-demand Services contribution margin turned positive in September, achieving 86% quarter on quarter improvement to -0.5% as a percentage of GTV, over the course of the quarter.

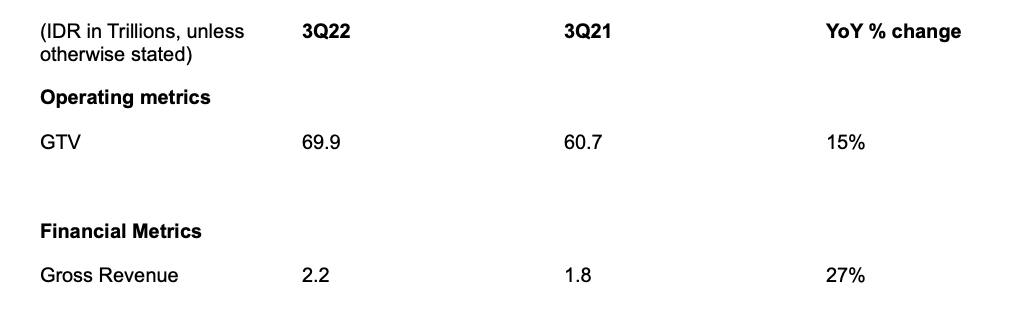

E-commerce

E-commerce achieved solid GTV growth of 15% year on year in the third quarter of 2022, despite customer behavior shifting toward more offline activities. Gross revenue growth continued to outpace GTV growth, up 27% year on year. This was driven by an increased C2C take rate as we implemented a new commission scheme for C2C merchants, the introduction of platform fees in July, and the strong adoption of value-added services, including ads and logistics. We also improved contribution margin, augmenting 33 basis points quarter on quarter to -1.1% as a percentage of GTV in the third quarter.

Due to improved monetization, C2C take rates improved by 31 basis points quarter on quarter. Further, incentives have been reduced by a spending cap that eliminates promotional spending on cohorts of unprofitable users.

Looking ahead, we will remain focused on improving take rates over the long term through bundling higher commissions, platform fees, and merchant-paid promotions with value-added services, including directed advertising and fulfillment services.

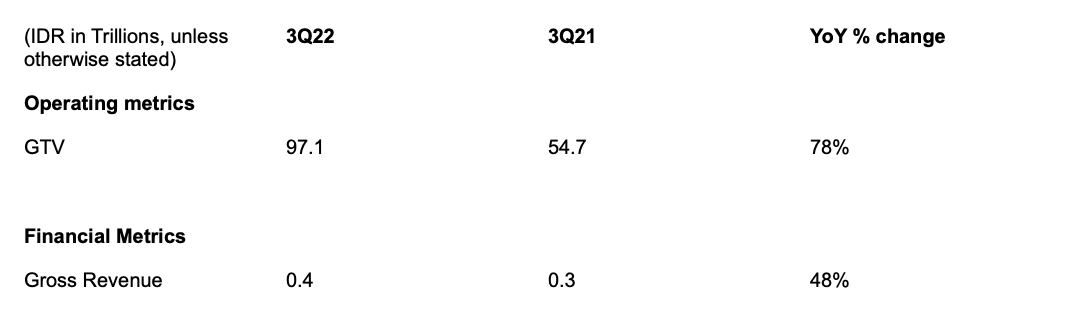

Financial Technology Services

The financial technology services business maintained its strong headline growth, with GTV and gross revenue increasing by 78% and 48% year on year, respectively. This is predominantly attributable to our efforts to deepen GoPay e-wallet penetration across the ecosystem and improve user base quality. Closed loop user penetration across Gojek and Tokopedia attained new highs in the third quarter of 2022, with more users using the GoPay e-wallet to transact within the GoTo ecosystem. GoPay user penetration reached 60% on Gojek and 58% on Tokopedia, up 5% and 6% quarter on quarter, respectively. Our merchant payments GTV grew faster than consumer payments, which resulted in a slight decline in the blended take rate..

User quality has continued to improve, with GTV per GoPay user increasing by 47% at the end of the quarter compared with the same period a year ago. This means that the average GoPay user is spending more and doing so with increasing frequency. During the quarter, we also made progress on our consumer lending program. Since we launched our installments lending product, GoPayLater Cicil on Tokopedia in July this year, we have whitelisted approximately four million customers. We will continue to scale our loan book going into 2023, but with caution, given credit cycles and macroeconomic conditions.

Moving forward, we will continue to improve contribution margin through further optimization of promotional expenses while shifting revenue mix to higher margin products, especially in lending, where we continue to test new products, such as cash loans which we began piloting in early October.

Environmental, Social and Governance (ESG)

We continue to invest to ensure we are in line with global and industry best practice when it comes to ESG performance. Outcomes from our third quarter ESG efforts include:

- Achievement of provisional AA rating by MSCI for Company’s ESG performance, ranking top of industry globally for climate action, and top quartile for data security, user privacy and labor management.

- Submission of its decarbonization targets to the Science Based Targets Initiative (SBTi), becoming the first technology company in Indonesia and the Southeast Asian region to do so.

- Achieved four million kilometers on two-wheel (2W) electric vehicles (EVs) through Electrum, a joint venture between GoTo and TBS Energi Utama, surpassing our one million target for end of year.

- Launched Tokopedia Hijau - our first e-commerce specific guidelines to support sellers’ transition to more sustainable operations, including the reduction of excessive packaging and operational costs.

Company Outlook

The Company remains focused on its path to profitability as its top priority. We expect to see ongoing sequential improvements in both contribution margin and adjusted EBITDA over the coming quarters. This will be driven by improvement in take rates, further rationalization of promotion spend and the identification and retention of high-quality core users.

For the full year 2022, the Company currently expects:

- GTV to be between Rp613 trillion and Rp619 trillion.

- Gross revenue to be between Rp22.6 trillion and Rp23.0 trillion.

- Contribution margin as a percentage of GTV to be between -1.09% and -1.06%, reaching between -0.6% and -0.5% in the fourth quarter.

For the contribution margin break even timeline, the Company reiterates its guidance:

- Group contribution margin to turn positive starting in the first quarter of 2024

- On-demand segment to achieve positive contribution margin by the first quarter of 2023

- E-commerce segment to achieve positive contribution margin by the fourth quarter of 2023

The above outlook is based on the current market conditions and reflects the Company’s preliminary estimates, which are all subject to various uncertainties, including those related to the ongoing COVID-19 pandemic.

- end -

About GoTo Group

PT GoTo Gojek Tokopedia Tbk (GoTo Group) is the largest digital ecosystem in Indonesia. GoTo’s mission is to “empower progress” by offering technology infrastructure and solutions that help everyone to access and thrive in the digital economy. The GoTo ecosystem consists of on-demand services (mobility, food delivery, and logistics), e-commerce (third party marketplaces + official stores, instant commerce, interactive commerce, and rural commerce), and financial technology (payments, financial services, and technology solutions for merchants) through the Gojek, Tokopedia, and GoTo Financial platforms.

Forward-Looking Statements

This document may contain forward-looking information or forward-looking statements (collectively, “forward-looking information”). All information contained in this communication that is not clearly historical in nature or that necessarily depends on future or subsequent events is forward-looking information prepared as of the date hereof and is based upon the opinions and estimates of management and the information available to management as of the date hereof. In some cases, forward-looking information can be identified by the use of forward-looking terminology such as "expect", "likely", "may", "will", "should", "intend", "anticipate", "potential", "proposed", "estimate" and other similar words, expressions and phrases, including negative and grammatical variations thereof, or statements that certain events or conditions "may,” or "will" happen, or by discussion of strategy. Forward-looking information is based upon a number of current internal expectations, estimates, projections, assumptions and beliefs that, while considered reasonable by management, are inherently subject to significant business, economic, competitive and other uncertainties and contingencies. Forward-looking information is not a guarantee of future performance and involves known and unknown risks, uncertainties and other factors (including the risks and uncertainties in the Company’s financial statements and Management Discussion & Analysis available on the Company’s website), that may cause actual results, performance or achievements to be materially different from the future results, performance or achievements expressed or implied by such forward-looking information. Any estimates, investment strategies or views expressed in this document are based upon current market conditions, and/or data and information provided by unaffiliated third parties, and are subject to change without notice. To the extent any information in this document was obtained from third party sources, the Company has not independently verified that information, and there is a risk that the assumptions made and conclusions drawn by the Company based on such information are not accurate. Except as required by law, the Company disclaims any obligation to update or revise any forward-looking information, whether as a result of new information, events or otherwise. Readers are cautioned not to put undue reliance on this forward-looking information.

Non-IFAS Financial Measures

To supplement GoTo Group’s consolidated financial statements, which are prepared and presented in accordance with statement of financial accounting standards in Indonesia (IFAS), GoTo Group uses the following non-IFAS financial measures including gross revenues, contribution margin and adjusted EBITDA, to understand and evaluate GoTo Group’s core operating performance. However, the definitions of GoTo Group’s non-IFAS financial measures may be different from those used by other companies, and therefore, may not be comparable. Furthermore, these non-IFAS financial measures have certain limitations in that they do not include the impact of certain expenses that are reflected in GoTo Group’s consolidated financial statements that are necessary to run GoTo Group’s business. Thus, these non-IFAS financial measures should be considered in addition to, not as substitutes for, or in isolation from, measures prepared in accordance with IFAS.

These non-IFAS measurements are not intended to replace the presentation of GoTo Group’s financial results in accordance with IFAS. Rather, GoTo Group believes that the presentation of Adjusted EBITDA provides additional information to investors to facilitate the comparison of past and present results, excluding those items that GoTo Group does not believe are indicative of GoTo Group’s ongoing operations due to their size and/ or nature. In addition, GoTo Group also presented the Contribution Margin that may provide additional information to investors in relation to the results excluding the non-variable expenses and other income/ expenses. Contribution margin and adjusted EBITDA presented herein may not be comparable to similarly entitled measures presented by other companies, who may use and define this measure differently. Accordingly, you should not compare this non-IFAS measure to those presented by other companies.

Unaudited and Pro Forma Financial Information

GoTo Group furnished the pro forma consolidated statement of profit or loss and other comprehensive income as if Tokopedia had been consolidated by GoTo for all the periods presented in this earnings release. The pro forma consolidated statement of profit or loss and other comprehensive income have been prepared based on the Company’s combined historical financial information, excluding the amount of historical financial information recognised as intercompany elimination item. Pro forma consolidated statement of profit or loss and other comprehensive income is not intended to be a complete presentation of the GoTo Group’s financial performance or results of operations had the transactions been concluded as of and for the periods indicated. In addition, these pro forma information are provided for illustrative and informational purposes only and are not necessarily indicative of the GoTo Group’s future results of operations or financial condition as an independent, publicly traded company.

The pro forma financial information included in this document has been prepared by and is the responsibility of management. This pro forma information has not been audited, reviewed, examined, or applied any procedures with respect to the pro forma financial information, included in this document . Accordingly, there are no opinions or any other form of assurance expressed with respect to any and all pro forma financial information presented in this document.

The pro forma financial information included in this document (i) is presented based on currently available information and estimates and assumptions that the GoTo Group’s management believes are reasonable as of the issuance date of this document; (ii) is intended for informational purposes only; and (iii) does not reflect all decisions that are undertaken by the GoTo Group after the acquisition.

While the pro forma financial information is helpful in illustrating the financial characteristics of the consolidated companies, it is not intended to illustrate how the consolidated companies would have actually performed if the acquisition of Tokopedia in fact occurred on the date of acquisition or to project the results of operations or financial position for any future date or period.

In addition, GoTo Group also furnished the result for the three months ended and nine months ended September 30, 2022 and 2021 in this document. This information is extracted from the consolidated financial statements of the Company as of September 30, 2022 and for the nine months ended September 30, 2022 and 2021 that has not been reviewed or audited. The consolidated financial statements as of September 30, 2022 and for the nine months ended September 30 2022 and 2021, have been prepared by and are the responsibility of management. This financial information has not been audited, reviewed, examined, or applied any procedures with respect to the consolidated financial information for the nine months ended September 30, 2022 and 2021, included in this document. Accordingly, there are no opinions or any other form of assurance expressed with respect to any and all interim financial information for the nine months ended September 30, 2022 and 2021 presented in this document.

Operating Metrics

LTM ATU or Last Twelve Months Annual Transacting Users means the number of unique transacting users in the trailing twelve months. GTV or Gross Transaction Value means gross transaction value, an operating measure representing the sum of (i) the value of on-demand services transactions; (ii) the value of e-commerce transactions for product and services; and (iii) the total payments volume processed through our financial technology services, excluding any inter-company transactions.

1 Comparisons are made against the pro forma financial and operating metrics for the nine months ended September 30, 2021, which were derived from the unaudited consolidated historical financial information of GoTo Group and Tokopedia and certain adjustments and assumptions have been made regarding our Group after giving effect to the acquisition of Tokopedia. Such numbers are presented for illustrative purposes only and may not be an indication of what the Company’s financial position or results of operations would have been or for any future periods.

2 GTV means gross transaction value, an operating measure representing.

a. the sum of the time value of the transactions from on-demand services.

b. the sum of the value of the product and services recorded on our e-commerce segment.

c. the sum of the total payments volume, or TPV processed through our platform of financial technology services.

d. and excluding amounts from intercompany transactions between entities within the Company that are eliminated upon consolidation.

3 Gross revenue represents the total Rupiah value attributable to GoTo Group from each transaction, without any adjustments for incentives paid to driver-partners and merchant partners or promotions to end-users, over the period of measurement. For a reconciliation of net revenue to gross revenue, please refer to the section “Non-IFAS Financial Reconciliation.”

4 LTM ATU means trailing twelve months of unique transacting users.

5 GoTo Group calculates the adjusted EBITDA, a non-IFAS financial measure, beginning with loss before income tax and adjusting for (i) depreciation and amortization expenses; (ii) finance income; (iii) interest expenses; (iv) loss on impairment of assets of disposal group classified as held for sale; (v) (reversal)/loss on impairment of investment in associates; (vi) loss on impairment of goodwill; (vii) fair value adjustment of financial instruments; (viii) loss on impairment of intangible and fixed assets; (ix) share-based compensation cost (including for the Gotong Royong Program); and (x) non-recurring items.

6 GoTo Group calculates the calculates Contribution Margin, a non-IFAS measure, beginning with net revenues and deducting total cost of revenues, a portion of sales and marketing expenses relating to the promotional excess and product marketing and others consists of mainly withholding taxes related to sales and marketing expense and other insignificant expenses

IMPORTANT DISCLAIMER: This document (1) may contain or reference a provisional ESG rating (and related research) of an entity for which MSCI ESG Research LLC has been compensated, (2) is not intended to reflect or consist of any investments or financial advice, recommendation or promotion, including regarding credit decisions or decisions to purchase, hold or sell any securities or strategies, (3) is based in whole or in part on information (some of which may be non-public) provided by or on behalf of the entity, (4) may not be redistributed without the express written permission of MSCI ESG Research LLC, and (5) is subject to each of the additional provisions of the disclaimer located at: msci.com/legal/provisional-rating.

Contacts:

Media

GoTo Group: corporate.affairs@gotocompany.com

FGS Global: GoTo-AP@fgsglobal.com

Investors/analysts

GoTo Group: ir@gotocompany.com

The Piacente Group: goto@thepiacentegroup.com